Building your strategic moat – a review of 7 Powers by Hamilton Helmer

Through insightful analysis and engaging examples, Helmer's 7 Powers outlines the seven fundamental competitive forces that allow companies to establish dominance, from the monopolistic rise of Standard Oil to Google's dominance in online search.

In today's complex and ever-shifting business landscape, gaining a competitive edge over rivals can seem nearly impossible. Yet, as strategic advisor Hamilton Helmer argues in his insightful book 7 Powers, the key foundations of competitive advantage remain remarkably consistent over time.

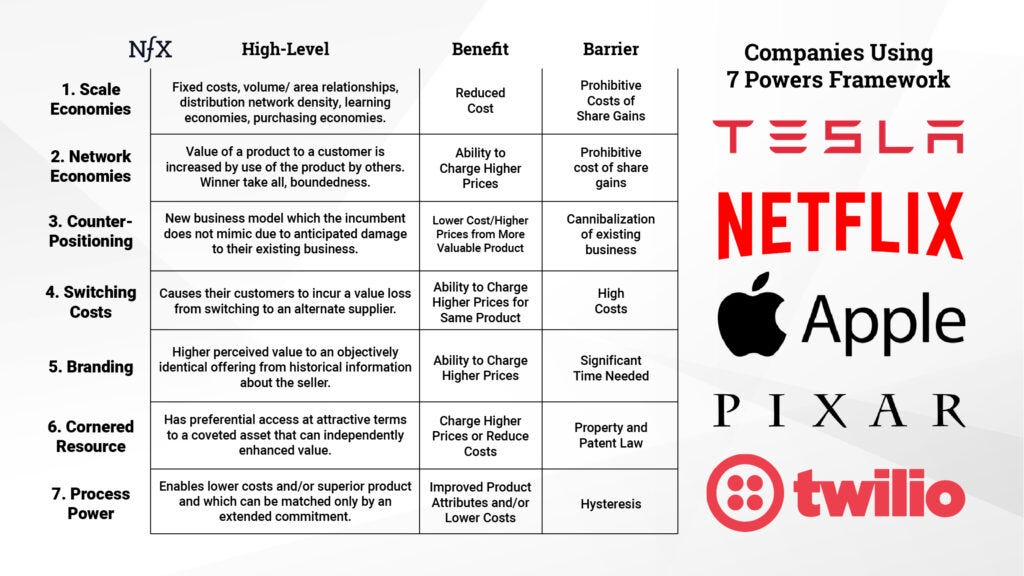

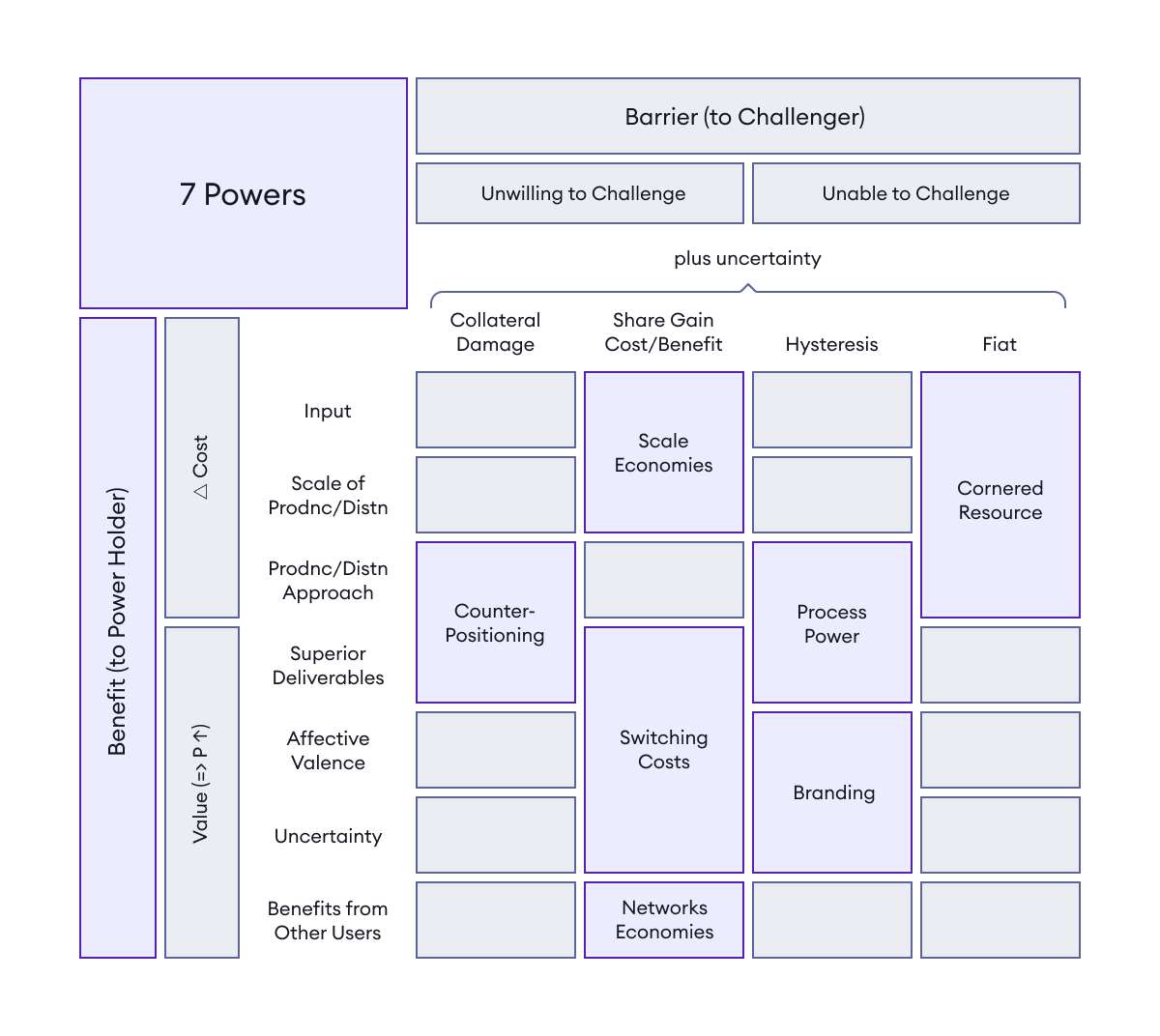

Through in-depth analysis and compelling examples, Helmer convincingly outlines seven elemental "powers" that allow companies to establish dominance in their industries. From the monopolistic might of Standard Oil to Google's reign over online search, Helmer explores how the 7 Powers of scale, network effects, counter positioning, switching costs, branding, cornered resource, and process have been leveraged by successful businesses dating back over a century.

This timeless and universal framework provides business leaders with an invaluable toolkit to assess their own competitive strengths and weaknesses.

Though the examples are retrospective, Helmer's framework provides a timeless and universal toolkit, allowing readers to assess their own competitive strengths and weaknesses within the 7 Powers. Both broad in scope and practical in nature, 7 Powers delivers an invaluable crash course on the core forces that determine competition.

Key Takeaways

- Compounding – Leading companies dominate through leveraging one or more of these 7 powers, such as Google achieving scale and network effects. The most successful companies combine and maximize more than one of the 7 powers at once.

- Timeless – Powers are timeless but must be adjusted over time - competitive advantage is not static. Implementing the 7 powers requires translating principles into concrete actions suited to your specific industry and company.

- Honesty – Companies need to honestly assess where they stand compared to competitors on each of the 7 powers.

- On The Offense – Competitive advantage comes from both leveraging your own powers and mitigating the powers of rivals.

"The greatest competitive advantage a company can achieve is to operate in an industry where competitive forces are intrinsically weak or muted. The ultimate prize is to dominate an industry where destructive competitive forces are minimal and perhaps even absent altogether."

The 7 Powers

Scale Economies

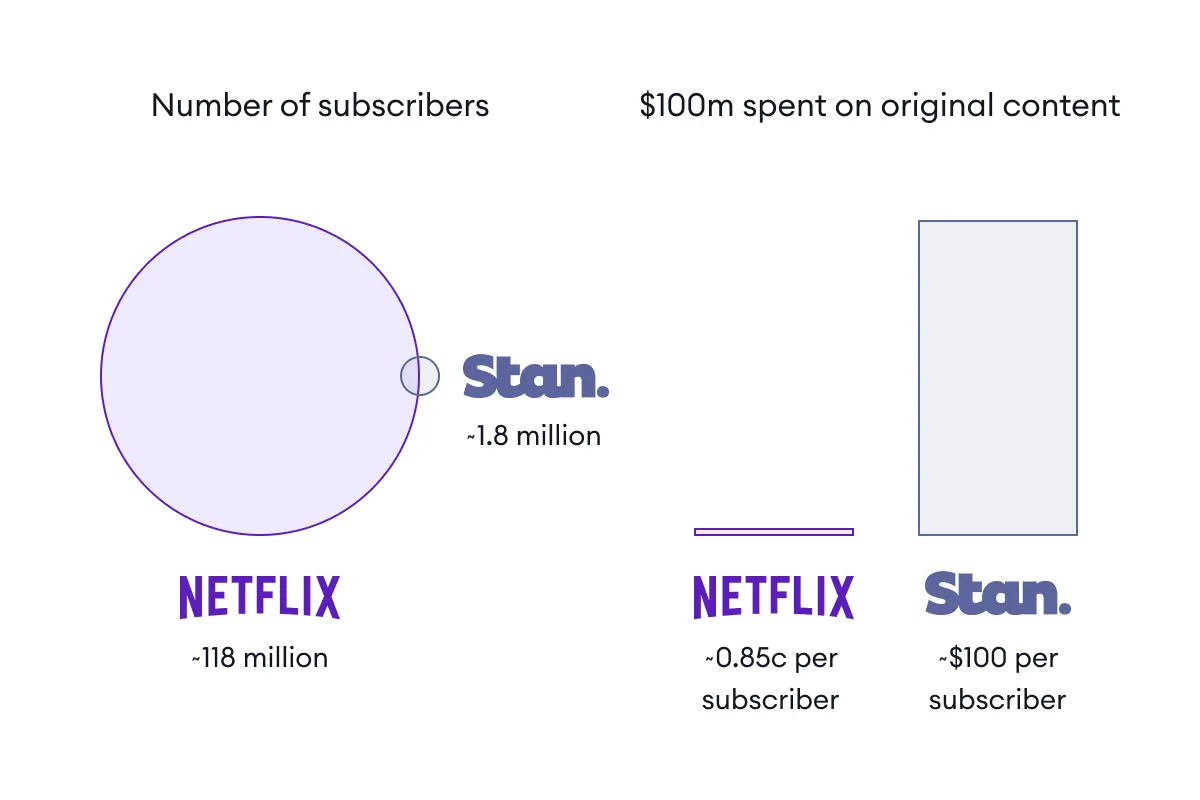

The most direct path to outcompeting rivals is simply becoming the biggest player in an industry. With greater size comes cascading advantages, from bulk discounts on materials to streamlined logistics. As Hamilton Helmer illustrates through case studies like Standard Oil and Amazon, the organizations that achieve dominant scale first are able to operate at lower costs than competitors. Just as impactful, massive size enables firms to set the very standards and systems that others must follow, like how Rockefeller's Standard Oil engineered methods of distribution and operation that persisted even after its monopoly dissolved.

Yet scale cannot be taken for granted - it requires constant investment and growth to maintain strength. Companies at the top must continually seek new customers and identify areas of unfulfilled demand to feed continual expansion. Though the benefits of scale have been understood for centuries, Helmer argues that even in today's technology landscape, size continues to confer unmatched structural advantages. In emerging fields like cloud computing or electric vehicles, reaching scale rapidly allows firms to cement their leadership for years to come.

Network Economies

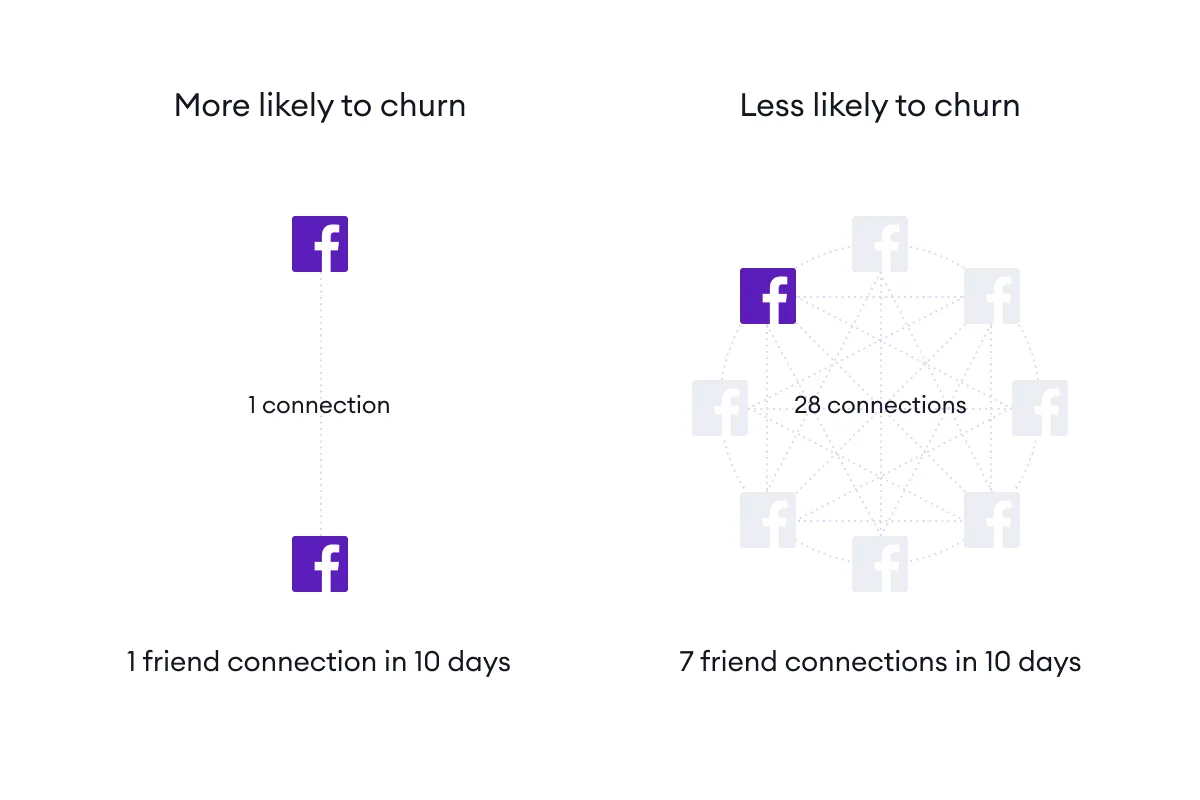

Networks exhibit exponential returns - each additional user or partner added makes the overall network more valuable for all participants. As Helmer explores through the rise of companies like Facebook and Airbnb, networks that reach critical mass achieve a flywheel effect, with each new node accelerating growth.

But reaping these networked rewards requires careful orchestration, as Apple demonstrated in cultivating an app developer ecosystem to boost iPhone's appeal. Once a sizable user base is established, the priorities shift to raising barriers around the network, through habits, switching costs, or exclusives. Helmer spotlights how Google solidified its leadership in search through agreements with Apple and other gateways to the internet. With users locked in, rivals like Bing face an uphill battle.

Network connectivity has always influenced the competitiveness of railway systems, telecommunications, and marketplaces. But Helmer underscores how today's digital landscape overwhelmingly favors scale and centralized networks, especially firms that control the most valuable data. In an internet-powered world, network effects reign supreme.

Counter-Positioning

In crowded or commoditized markets, offering an intentionally contrasting alternative to the status quo can confer advantage. As Helmer examines through disruptors like E*Trade and Avis, counter positioning allows entrants to flip the script - by framing differences from incumbents as selling points.

When products become interchangeable, customers crave differentiation. New entrants do not try to beat established players at their own game. Instead they separate themselves by lean into contrasts, be it through lower costs, unique features or branding focus. Avis' "We Try Harder" campaign openly admitted it was not number one, spinning its underdog status as superior service. E*Trade trumpeted online stock trading as simpler and cheaper than relying on traditional brokerages. While risky, Helmer argues that counter positioning remains one of the most reliable strategies for upending entrenched categories by changing the bases of competition altogether.

Branding Power

Customers do not make decisions solely on functional characteristics - strong brands forge emotional connections through carefully crafted identity and reputation. As Helmer explores through iconic brands like Coca-Cola and Nike, compelling stories and experiences allow companies to command irreplaceable customer loyalty, even at higher prices.

The most effective brands intertwine feelings of nostalgia, personal identity, and belonging to their products. Decades of advertisements, promotions, and sponsored events have linked Coca-Cola to positive memories and nationalism. Once brands attach to individual self-image, they are hard to displace - devotees proudly display logos and immerse themselves in branded communities. With trust established, these companies can explore higher margin products and enter new markets with built-in advantage. In a world where production advantages are easily replicated, Helmer underscores the rising importance of brands that tap directly into human psychology and emotion.

Cornered Resource

Controlling a valuable resource competitors cannot easily access or substitute confers significant structural advantage. As Helmer details through examples like DeBeers in diamonds, cornering a critical input allows companies to shape entire industries to their favor. The resources in question could be physical, like oil reserves, or intangible assets like data, patents, or governmental access. Regardless of type, the organizations that dominate unique resources are able to set favorable terms for rivals and erect barriers.

Maintaining control requires actively limiting and blocking competitors from accessing the same resources through legal, technological, or strategic means. DeBeers for decades limited worldwide diamond supply to keep prices high. Companies like Facebook and Google impose restrictions on APIs and data sharing to prevent competitors from replicating their assets. As technology redefines scarce assets, Helmer notes that more industries will be defined by whoever corners datasets and algorithms. But while resources change, the strategic imperative remains constant - leverage control of critical inputs others vitally need.

Process Power

Mastering proprietary systems and methods that underpin operations can provide lasting strategic advantage. As Helmer explores through Amazon and Netflix, process innovations are challenging for rivals to replicate, especially at scale. The organizations that continually refresh and enhance their logistics, algorithms, and infrastructure force competitors into a never-ending game of catch-up.

Amazon's emergence was fueled by supply chain and distribution processes that enabled new levels of speed and efficiency. The sophistication of Netflix's recommendation engine allows more personalized, addictive content. While imitators can attempt to build similar systems, Helmer notes they are already behind and lacking iterative enhancements. With the processes and intelligence invisible to outsiders, it becomes nearly impossible to match the market leaders. As such, continuous refinement of core operating processes is just as vital as more visible product innovation. The internal methods powering the delivery of goods, information and services represent key sources of defensible advantage.

Switching Cost Power

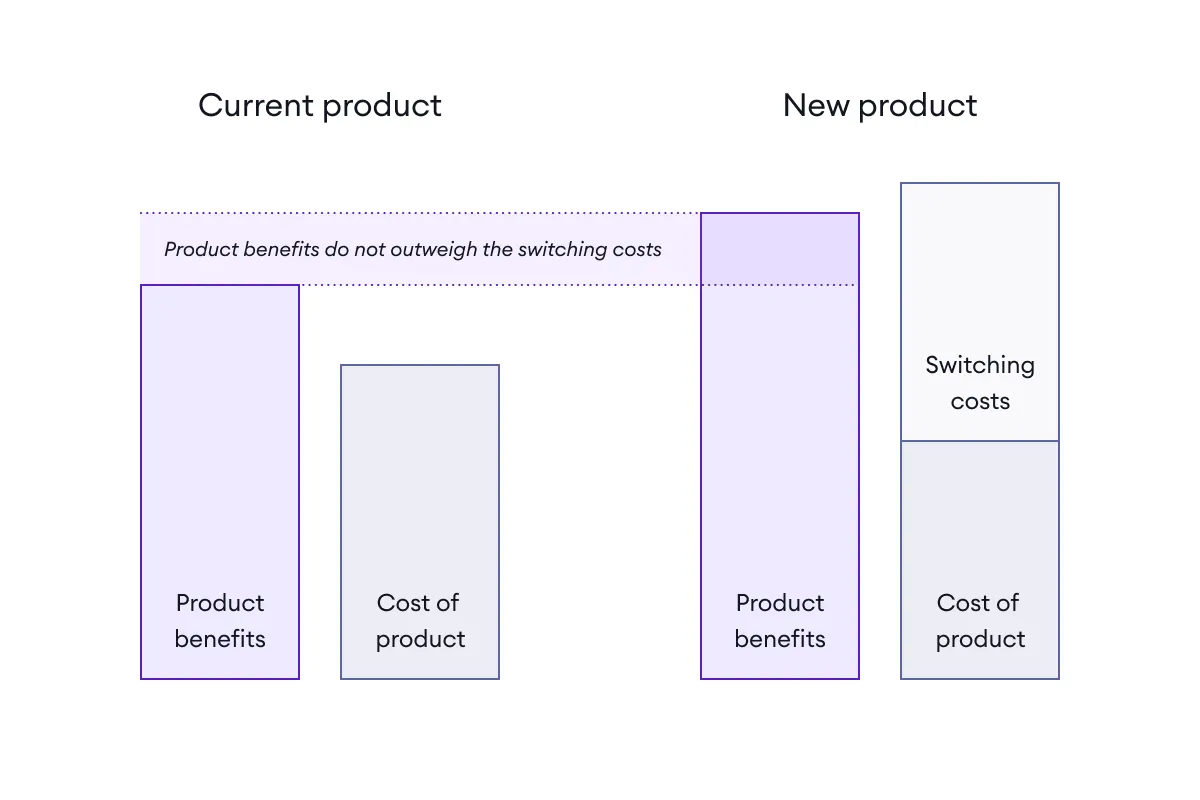

Rather than winning on merit alone, companies can structure offerings to impose high costs for leaving. As Helmer explains, switching costs create inertia by making it exceedingly difficult for users to depart, even when competitive alternatives exist. Firms like Apple are masters at layering on subscriptions, habits, data migration fees and other barriers that rationally or emotionally trap customers.

Switching costs manifest in many forms - from enterprise software contracts with exit penalties, to consoles like Xbox that tether gamers to painstakingly assembled libraries. Apple's ecosystem syncs multiple devices and media seamlessly, while those starting fresh with Android face disruption. Helmer notes that while manipulative, switching costs are highly effective at sustaining Advantage. Users stay out of sheer hassle, not merit. However, firms must continue earning loyalty by enhancing value, as customers will eventually jump if stagnation sets in. Wielding switching costs buys time, but lasting success depends on innovation against captive audiences.

Bringing it all together

In the cutthroat arena of business, gaining an edge often seems to rely on intuition, aggressiveness and a bit of luck. Yet in 7 Powers, Helmer persuasively argues that the ingredients for competitive advantage are both timeless and learnable.

By distilling these forces into seven elemental powers spanning from scale to branding to processes, Helmer provides a framework for analysis that is at once broad in scope yet practical in nature.

Managers can diagnose their own strengths, weaknesses, and strategies compared to rivals across the 7 powers.

While retrospective at times, the examples never feel dated due to Helmer’s insights into how technological shifts have opened new frontiers for these enduring principles. Thanks to its universal applicability and thoughtful exploration of power dynamics, 7 Powers delivers an invaluable education for leaders seeking to build unshakeable competitive strength into their organizations.

The principles form a toolkit ready to be applied to any present or future industry.