Understanding Michael Porter

Michael Porter's foundational concepts like the Five Forces and value chain fundamentally shaped the field of business strategy. This indispensable book by Joan Magretta provides a concise yet thorough distillation of the professor's core strategic principles that continue influencing today.

Michael Porter has been one of the most influential thinkers in the field of strategic management since the publication of his first book, Competitive Strategy, in 1980. Porter, an economist and professor at Harvard Business School, developed groundbreaking frameworks for analyzing industries and formulating strategy.

His foundational Five Forces model examines the dynamics between competitors, suppliers, buyers, substitutes and new entrants to determine profit potential in a given market. Additionally, his concepts of generic competitive strategies and the value chain have become go-to tools for crafting and executing successful business plans.

Given his outsized impact, there is much interest in deeply understanding the core principles at the heart of Porter's strategic philosophy. This book, Understanding Michael Porter: The Essential Guide to Competition and Strategy, provides a comprehensive overview and synthesis of Porter's most important frameworks, ideas and teachings over his long career.

The author and Porter scholar, Joan Magretta, distills the wisdom from Porter's many writings and papers into one accessible volume. In clear and practical language, Magretta outlines Porter's approach for analyzing industrial economics, strategic positioning, and building competitive advantage. For any student or manager looking to apply Porter's concepts to real business challenges, this is an essential read.

The thesis of this book review is that Understanding Michael Porter succeeds in highlighting the most vital insights from Porter's work that continue to shape business strategy today.

By focusing on key models such as the Five Forces and value chain, Magretta elucidates the foundational principles behind Porter's enduring strategic philosophy in a concise and approachable guide. While Porter's ideas have limitations in fast-changing digital markets, this text convincingly outlines his core set of tools and frameworks that still offer valuable strategic guidance in many industry contexts.

For these reasons, Understanding Michael Porter emerges as an indispensable book for internalizing Porter's strategic wisdom.

Summary of Main Points

Magretta effectively summarizes the main tenets of Porter's strategic thinking by focusing on his most widely used concepts and models.

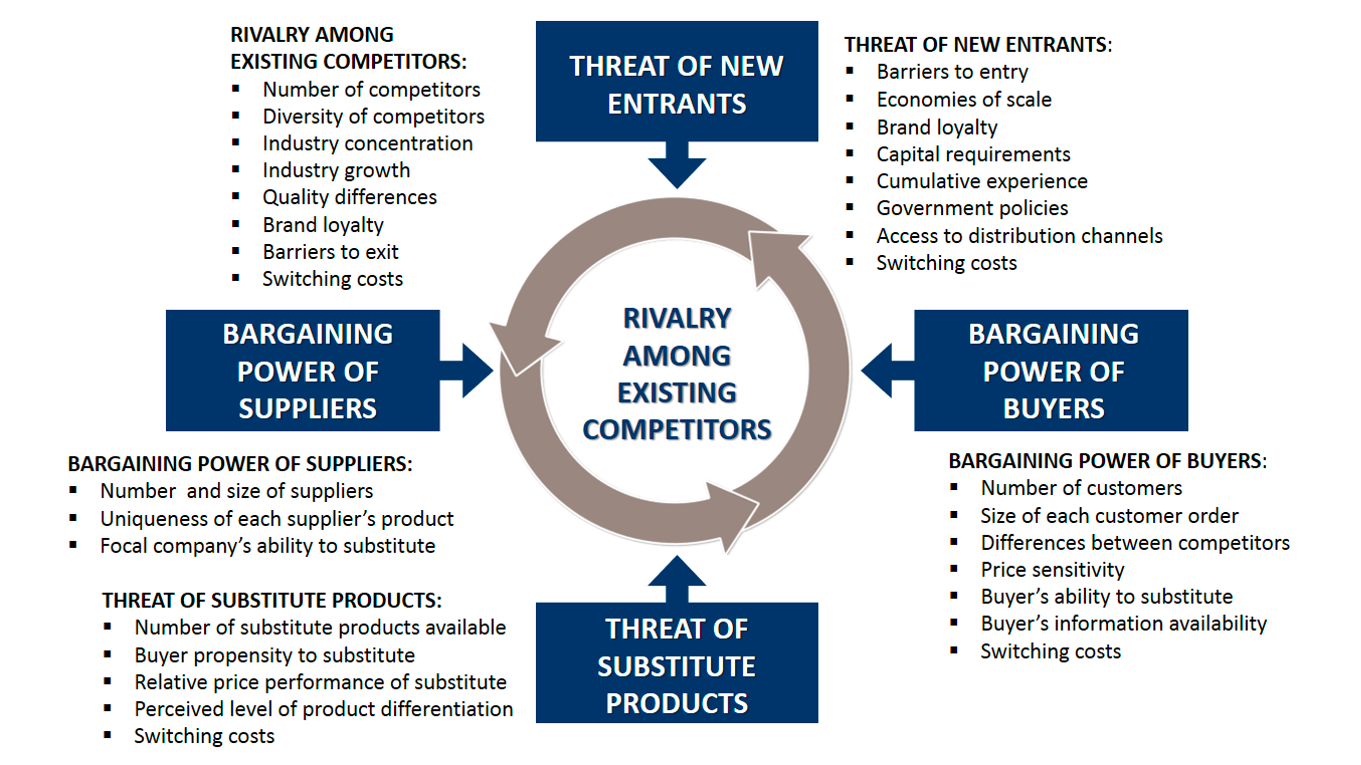

Five Forces

First, she examines Porter's Five Forces framework for industry analysis. This considers the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and jockeying between competitors. By analyzing these five forces, strategists can determine if an industry is attractive for profitability. Porter argues these forces are more important than macroeconomic factors in shaping profit potential.

The Five Forces model is arguably Porter's most well-known and influential framework for industry analysis. The model identifies five key forces that determine the profitability potential within an industry:

- Competitive rivalry among existing firms - This force examines how intense competition is between established companies in the industry. A high degree of rivalry, such as jostling for market share, typically limits profit potential.

- Threat of new entrants - This examines how easy or difficult it is for new competitors to enter the industry. Industries with high barriers to entry (e.g. large capital requirements) deter new entrants and support higher profits.

- Bargaining power of suppliers - This force analyzes how much leverage a firm's suppliers have in negotiations. Suppliers with high bargaining power can negatively impact a firm's margins.

- Bargaining power of buyers - Similarly, this force looks at the leverage customers have in negotiations. Powerful customers can force prices down in an industry.

- Threat of substitute products or services - This force considers the presence of products or services from outside the industry that meet the same customer needs. Close substitutes place a ceiling on potential prices and profits.

Porter argues strategists must deeply understand these five forces to determine if an industry is truly attractive. By performing a 5 Forces analysis, strategists can identify profitability hot spots or areas of threat to avoid. The model has become a staple of strategy research and planning in firms across industries.

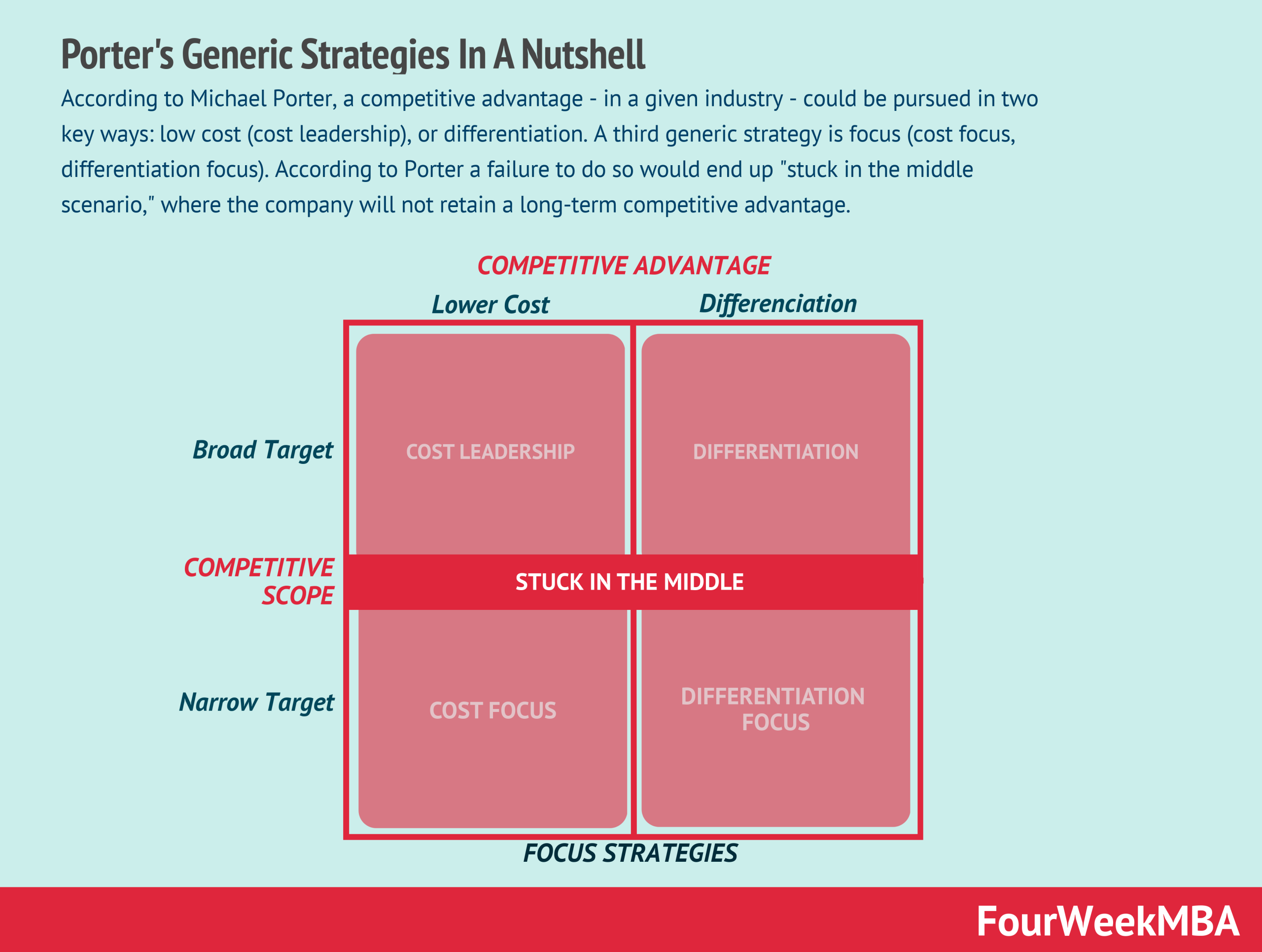

Generic Strategies

Porter argues there are three basic strategic positions that firms can adopt to outperform rivals in an industry: cost leadership, differentiation or focus. Pursuing one of these "generic strategies" is imperative, as firms that are "stuck in the middle" between them will be at a disadvantage.

- Cost Leadership

The cost leadership strategy involves firms striving to have the lowest costs in the industry to achieve higher profits than competitors. Firms pursuing cost leadership must be stringent in controlling costs across all activities in the value chain. This may require high production volumes, tight cost control, avoidance of marginal customer accounts, and cost minimization in areas like R&D, sales force, advertising etc. A cost leadership strategy aims to exploit scale advantages and compete on price. - Differentiation

A differentiation strategy aims to distinguish a firm's product or service from competitors' offerings through unique features, functionality, performance etc. that are valuable to customers. This allows firms to command premium prices, offsetting higher costs from investing in differentiation. Differentiation may occur anywhere in the value chain, such as R&D, superior materials, engineering, customer service etc. Effective differentiation creates brand loyalty and lowers sensitivity to price. - Focus

The focus strategy concentrates on serving a particular buyer group, product segment or geographic market extremely well. Focus involves targeting a specialized, under-served niche where large players may not compete effectively. Focus strategists serve their narrow target expertly through differentiation, cost leadership or both. Focus requires understanding the niche's unique preferences and needs.

Porter contends firms must make a strategic choice to pursue cost leadership, differentiation or focus rather than getting "stuck in the middle." These generic strategies offer distinct paths to carving out a competitive advantage relative to industry peers.

Next, Magretta covers Porter's ideas on generic competitive strategies, namely cost leadership, differentiation and focus. Firms must choose to pursue lower costs than rivals, differentiate their products/services, or focus on a narrow segment.

A firm that "sticks in the middle" between these strategies is in a poor strategic position. Porter argues combining multiple strategies dilutes competitive advantage.

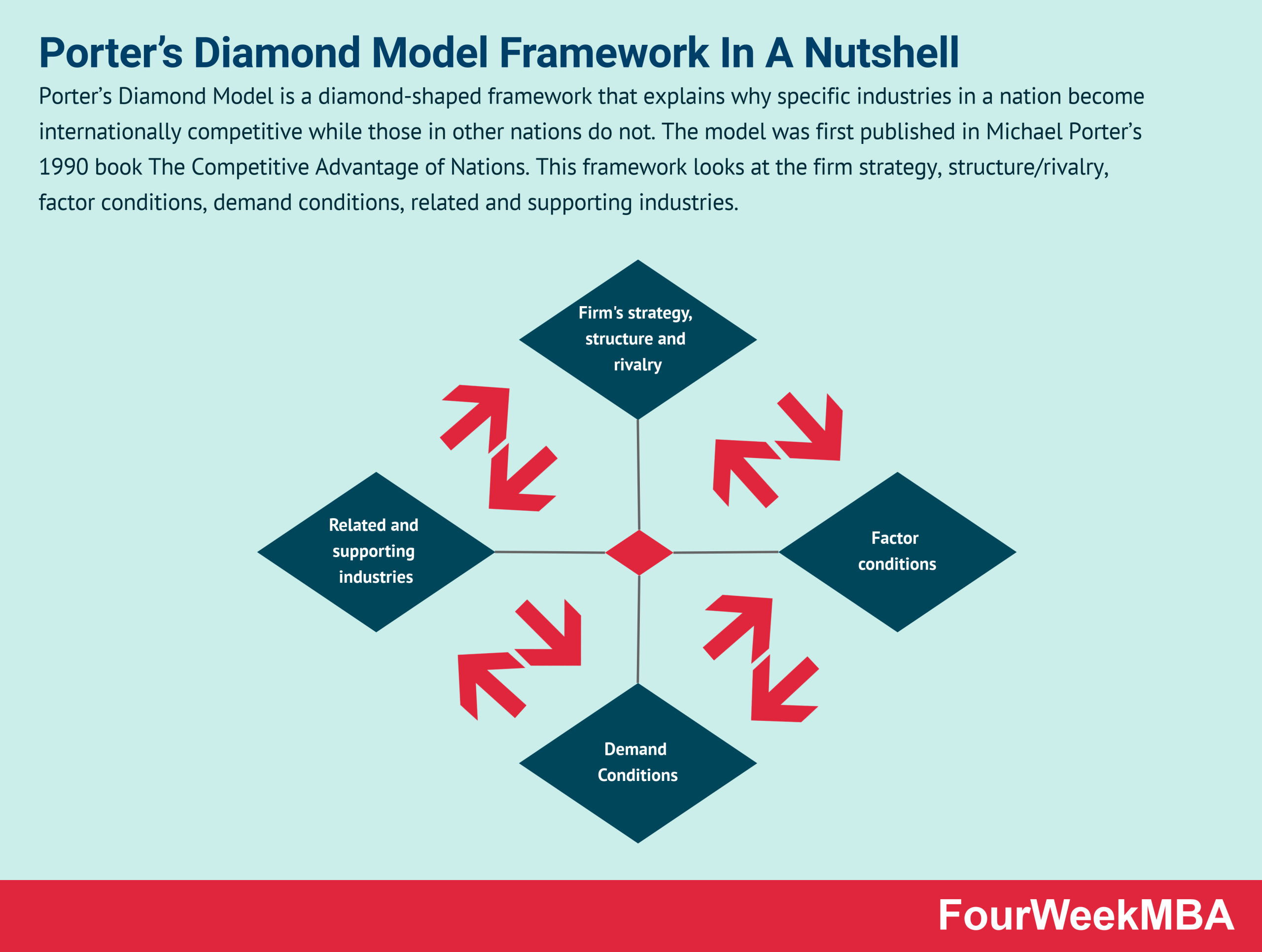

Diamond Model

The diamond model is Porter's framework for explaining why some nations are competitive in certain industries. The model points to four determinants of national advantage that shape the environment for domestic firms:

- Factor Conditions - This refers to a nation's factors of production like land, labor, capital, infrastructure etc. Abundant factors like skilled labor, capital and high-tech infrastructure enable firms to effectively compete in given industries. Scarce factors present challenges.

- Demand Conditions - This examines the nature of domestic demand for products and services made in a nation. Sophisticated, demanding local customers pressure firms to innovate and respond to needs. This provides competitive advantage.

- Related and Supporting Industries - Having domestically based suppliers and related industries facilitates information exchange and synergies that benefit domestic firms. Close working relationships boost efficiency.

- Firm Strategy, Structure and Rivalry - Domestic conditions shape how companies are created, organized and managed as well as the intensity of rivalry within the nation. Strategic choices in areas like training and incentives also impact competitive advantage.

The determinants in the diamond are self-reinforcing. For example, vigorous domestic rivalry upgrades factor conditions over time. The model highlights how home nation conditions form the environment in which competitive advantage is built.

While the diamond model has limitations, such as downplaying role of government, it provides useful framework for diagnosing national competitive advantage. The model has been employed in cases from semiconductor industry competitiveness to the rise of Silicon Valley. Overall, Porter's diamond model elegantly explains why some nations triumph in certain global industries.

Value Chain Analysis

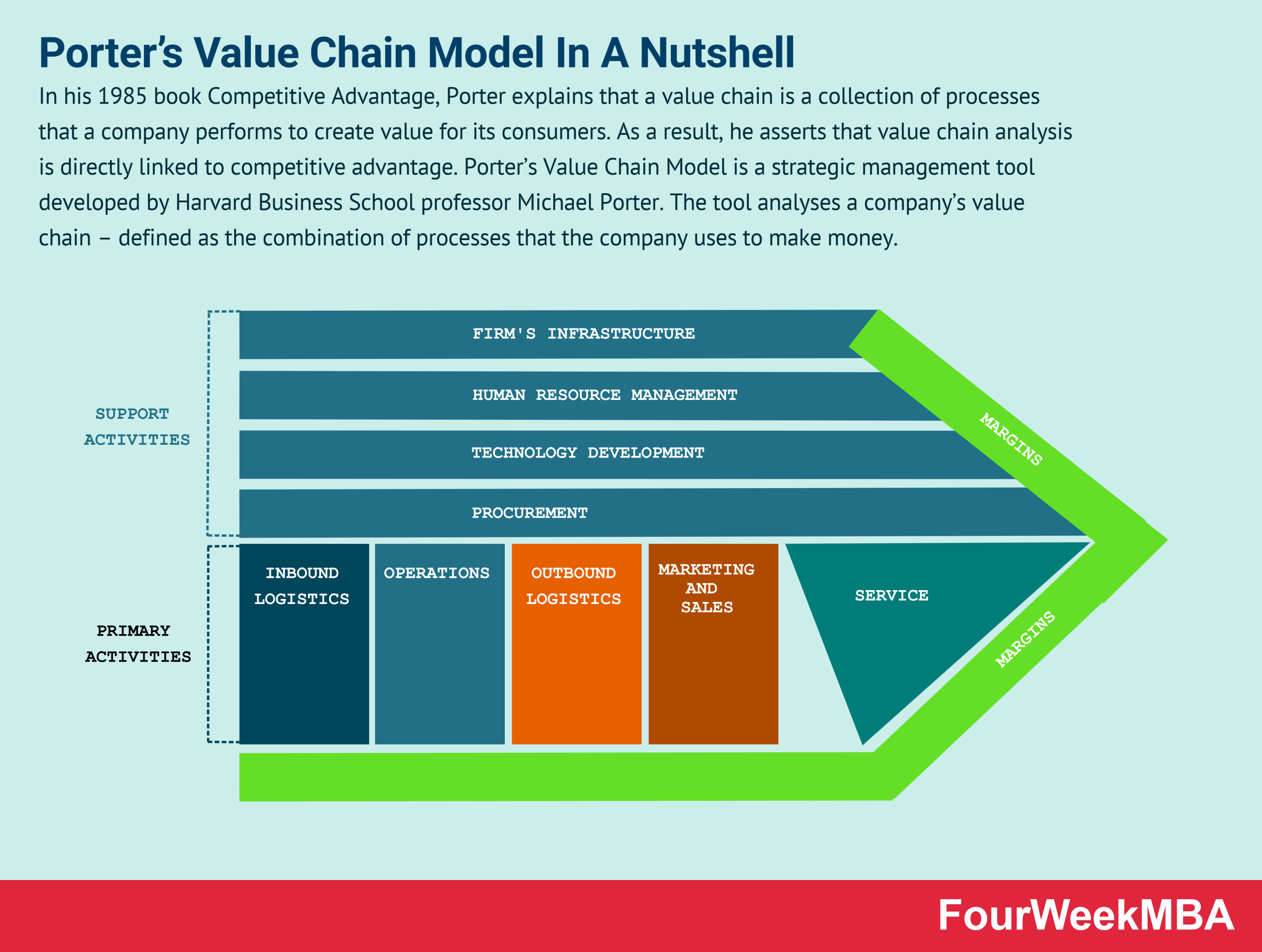

The value chain concept is another central strategic framework from Porter that analyzes the flow of activities within a firm to identify sources of competitive advantage. According to this model, companies can be visualized as a chain of discrete but connected functions that work together to design, produce, market, deliver and support a product or service.

The value chain categorizes company activities into two sets - primary activities and support activities. Primary activities are functions directly involved in producing and delivering the core product or service, while support activities provide infrastructure to enable the primaries.

Specifically, the primary activities in the chain are:

- Inbound logistics - Activities related to receiving/storing inputs like raw materials, parts etc.

- Operations - Transforming inputs into final products through manufacturing, assembly etc.

- Outbound logistics - Distributing final products to customers

- Marketing and sales - Promoting and selling products to customers

- Service - Maintaining product performance after sale through support, repairs etc.

The support activities in the value chain are:

- Procurement - Sourcing raw materials/inputs

- Technology development - R&D, product design, analysis

- Human resource management - Recruiting, developing, compensating personnel

- Firm infrastructure - Management, legal, finance, planning, IT systems

According to Porter, strategists can gain advantage by optimizing individual activities to reduce costs or boost differentiation. Trade-offs may be required between primary and support activities. The chain also highlights linkages and interdependencies between activities that may present optimization opportunities through coordination.

Overall, the value chain framework empowers firms to identify their most valuable activities and re-configure their operations to maximize competitive advantage industry-wide. It remains one of Porter's most useful strategy tools.

In total, these concepts form the backbone of Porter's strategic perspective focused on industry dynamics, competitive positioning and leveraging internal activities to build advantages over rivals. Magretta does an excellent job distilling Porter's extensive writings into these core ideas.

Applying the ideas

For business students or managers looking to deeply grasp Porter's strategic philosophy, Understanding Michael Porter represents a worthwhile, illuminating read. Magretta's distillation of Porter's extensive writings provides an accessible synthesis of his core concepts and models.

The book's strength lies in its researched grounding directly in Porter's academic work. Magretta takes care to explain the nuances of frameworks like the Five Forces and value chain based on Porter's intentions. This makes Understanding Michael Porter an authoritative resource for internalizing the principles at the heart of Porter's thinking.

At just over 200 pages, the book is focused and concise enough to digest Porter's central ideas without getting overly dense. Magretta's clear writing and organization helps convey even somewhat complex frameworks like the diamond model in understandable terms.

That said, the book's tight academic focus does mean it can feel light on examples of concepts in action. While Magretta outlines Porter's frameworks elegantly, more case illustrations demonstrating real-world application may enhance the lessons. As is, readers are left to make some leaps in envisioning how firms utilize Porter's tools in practice.

Overall though, for grasping Porter's vital strategic concepts - like the Five Forces and value chain - and understanding his philosophy as a whole, this book represents an indispensable resource. The depth of research and synthesis of Porter's work makes Understanding Michael Porter a worthwhile read for any student of strategy looking to master foundational principles in the field.

More applied examples would be a bonus, but the book succeeds in covering Porter's seminal ideas in a focused, digestible fashion.

Conclusion

Michael Porter has unequivocally left a significant mark on the field of strategic management since the 1980s. His frameworks for analyzing competition, industries, and sources of advantage fundamentally shaped how practitioners and academics think about strategy. Concepts like the Five Forces, generic strategies and value chain have become integral to strategic analysis.

This book, Understanding Michael Porter, succeeds in providing a focused synthesis of the core principles at the heart of Porter's influential perspective. Magretta distills Porter's extensive body of work into a concise overview of his vital concepts such as the Five Forces, value chain, generic strategies and diamond model. In clear language, she elucidates the backbone of Porter's strategic philosophy focused on industry dynamics, competitive positioning and internal configuration.

While aspects of Porter's perspective like the Five Forces have limitations in today's dynamic environments, his analytical frameworks remain relevant in many industry contexts. The tools provided by Porter for diagnosing competition, finding attractive positions within an industry, and leveraging interlinked activities to maximize value continue offering crucial strategic insights for managers across firms. Much of his fundamental thinking on strategy endures into the present.

In summary, this book succeeds in highlighting the essential components of Porter's vital contribution to strategic management. For any student looking to understand Porter's perspective, internalize his foundational concepts, and see his principles in action, Understanding Michael Porter delivers as an indispensable guide. By condensing Porter's central ideas into a concise, accessible work, Magretta provides an illuminating resource that cements Porter's legacy as one of the most impactful thinkers in strategic management.